Eco-design in retail: Make sustainability a brand differentiator in 2026

December 12, 2025

Shoppers expect sustainability, and retail needs to catch up

Sustainability has been in the conversation for so long that it’s easy to assume it’s lost its edge. Many brands quietly believe the topic has peaked, that shoppers have heard it all before, and the urgency has worn off. But if you look at how people are actually shopping, the opposite is true.

Younger buyers are leaning in. Almost 65% of Gen Z and 63% of millennials say they’re willing to pay more for eco-friendly products. These are signals about what the next wave of shoppers expect as standard. In Asia Pacific, the shift feels even sharper, with seven in ten people stating that climate change affects their day-to-day lives. That’s why shoppers across the region are ready to pay roughly 11% more for sustainable options.

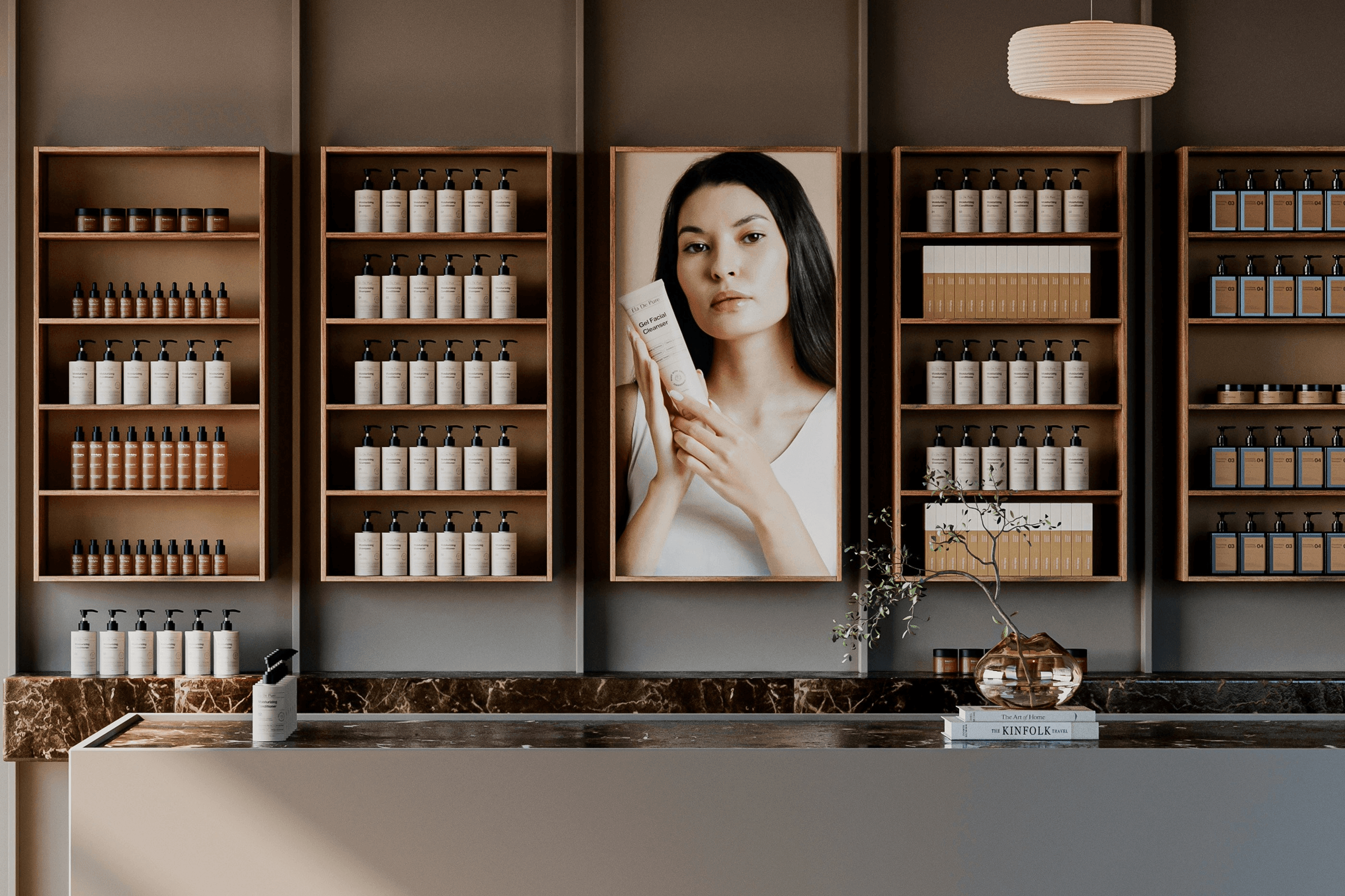

Yet this rising demand hasn’t translated into rising trust. Shoppers hear sustainability claims everywhere, but they don’t always see the evidence where it matters most, in the retail environment. People are now evaluating the entire setup, including packaging, display, finishes, and materials, rather than just the product. A brand might sound responsible online, but if the shelf tells a different story, the promise breaks instantly.

At the same time, shoppers don’t want to compromise on their experience at the cost of sustainability. They want eco-friendly options that still feel premium, convenient, and easy to use. They’re not looking to trade down; they’re looking for brands that can deliver both.

Which brings us to the real question for retail teams today: If shoppers expect sustainability and a seamless experience, what is stopping brands from delivering both consistently in-store?

The gap between ambition and reality in retail activation

Most brands have clear sustainability intentions. The challenge is translating those intentions into retail activation, an environment shaped by speed, volume, and fragmented execution. What appears achievable in a global framework often becomes far more complex when applied to local market and in-store conditions. Here’s where the friction shows up most:

Higher upfront cost

Sustainable materials can reduce waste and costs over time. However, they require an initial investment, and that’s where some friction lies. Shopper marketing budgets are built around short-term cycles and immediate sales targets.

As a result, sustainable builds often lose out to more affordable, single-use options that hit visual impact requirements without challenging budget approvals.

Supply chain limitations

Sustainable materials sound good in theory, but they’re not always easy to procure. They often require different machines, inks, or suppliers, and those aren’t available in every market.

This becomes a problem because retail runs on tight timelines. Campaigns are often approved late, retailer requirements change frequently, and production windows are short. Teams rarely have the time to source a new vendor or wait for a material to be imported.

Material performance under store conditions

Retail may look polished on the surface, but it’s a harsh environment for materials. Lighting, humidity, and even frequent touching affect the display assets. Traditional display materials were chosen because they’re predictable under these conditions. Sustainable substrates don’t always behave the same way.

Some absorb ink differently, which can reduce vibrancy. Others react to moisture or temperature changes, causing slight warping or bending. Even these minor differences become apparent quickly in high-traffic categories like beauty, where the expectation is for a flawless, high-gloss finish.

Regional variation

Every country has its own unique climate, retail setup, waste management system, and production capabilities, which shape what sustainable means for them. A material that works perfectly in Seoul may fail in Jakarta’s humidity. A substrate that’s recyclable in Australia may end up in a landfill in the Philippines.

Because of this, brands can’t apply a single global guideline across the region. They need a partner who can help them adapt to various markets.

Regulatory pressure

The regulatory landscape is shifting faster than most retail playbooks. Extended Producer Responsibility laws, plastic bans, and category-specific packaging rules are being implemented across Southeast Asia at varying speeds. This creates constant pressure to reassess materials.

Substrates that were standard two years ago now trigger compliance questions or retailer rejections. That uncertainty adds yet another layer between intention and execution.

Eco-design offers a practical way to close this gap

All the constraints in retail activation point to the fact that sustainability has to be designed into the system, not added on at the end. That’s the role of eco-design.

Eco-design doesn’t chase a single green material. It examines the full lifecycle of a retail asset, from its creation to its in-store performance, the frequency of refreshes or reuse, and its disposition at takedown. It replaces one-off choices with a framework that supports durability, flexibility, and responsible end-of-life outcomes. Here is how the eco-design principles promote sustainability:

Modularity reduces operational complexity

In fast-turn retail, teams constantly rebuild displays from scratch. That repeated reinvention consumes time, generates waste, and leaves little room for sustainable decisions.

That changes with modular displays, where the core structure remains the same, while only the creative elements are changed. Dimensions, hardware, and assembly remain consistent, which shortens production timelines, reduces errors, and removes much of the back-and-forth that slows campaigns down. Printers know the formats, stores know the setup, and teams can plan with far more predictability.

A notable example is the "Find Your Fenty Fit" pop-up tour in Australia. The experience moved across four cities on a premium, transportable architecture designed to be reconfigured rather than rebuilt. Only select elements changed between locations, proving that modularity can support both creative ambition and operational efficiency.

Eco-friendly materials now meet the demands of the aisle

Retail now has a wider set of eco-friendly materials that can stand in for the plastics, foam boards, and fillers traditionally used in POSM and packaging. Fiber-based boards, such as Re-board and other cellulose composites, are being used for display structures, headers, and lightweight fixtures because they offer good print quality and remain rigid enough for most in-store applications. rPET sheets are replacing virgin PET in trays, dividers, and display windows, giving similar clarity and durability with a lower impact. For packaging, compostable or recycled cardboard solutions are replacing bubble wrap and plastic fillers.

Displays can be created for a cleaner end of life

In retail, the biggest sustainability failure happens when the display comes down. Most waste is generated at takedown because many units are built from mixed materials that can’t be separated, plastics that become contaminated with adhesives, or boards that local recycling systems don’t accept. When components can’t be pulled apart cleanly, the whole display ends up in a landfill, even if individual parts were technically recyclable.

Eco-design tackles this by planning for the end of life from the start. This means using single-material constructions where possible, avoiding unnecessary laminations or glues, and selecting substrates that local recyclers actually process. When displays are built with disassembly and recycling in mind, far more material can be recycled instead of going to the landfill.

Packaging and display can be used for sustainable storytelling

Research shows that sustainable storytelling strongly boosts purchase intent. At the same time, sustainability claims are more effective when shoppers can see the proof for themselves, and the aisle is often where that proof is most visible. While brands should still be cautious of greenwashing, when materials, formats, and finishes reflect responsible choices the store becomes a credible extension of the brand’s values without needing long explanations.

Lush is one of the clearest examples of this in action. With around two-thirds of its products sold “naked,” the absence of packaging becomes part of the brand experience. Rows of unwrapped soaps and solid shampoos communicate the sustainability story instantly.

Where brands can stand out in 2026

Sustainability won’t set brands apart because they talk about it; shoppers have heard the claims for years. It will matter because brands can deliver it in the one place where intentions are tested: the retail environment.

Eco-design makes that possible. By stabilizing build cycles, improving material choices, planning for end-of-life, and letting the store carry the story, sustainability becomes a tangible reality that shoppers can see and trust.

Loading...